Once away from the security of home, many college students have to make their own financial decisions.

Credit cards are popular and can offer many benefits, but they also can have incredible downfalls.

"College students, like adults, deserve access to credit cards," said Jamie Grady, a Wachovia spokesperson. "Having a credit card has almost become a necessity in order to make travel arrangements, rent a car or purchase services over the phone and online."

Credit cards have many benefits if they are used wisely, said Edward Tonini, director of education for Alliance Credit Counseling, Inc.

They offer credit-building assistance, convenience, protection and ways to keep track of spending.

"But a credit card is not a necessity," Tonini said.

The right time to get a credit card may depend solely on the individual.

"For most, the right time to get a credit card would be when they move out and become financially independent," said Sven Thommesen, an economics professor. "Like it or not, our society lives on credit and you need to build your credit score. Having a source of emergency cash is extremely useful until you can save enough to build an emergency fund."

According to a press release by the Office of the Press Secretary for the White House, Americans pay $15 billion in credit card fees every year.

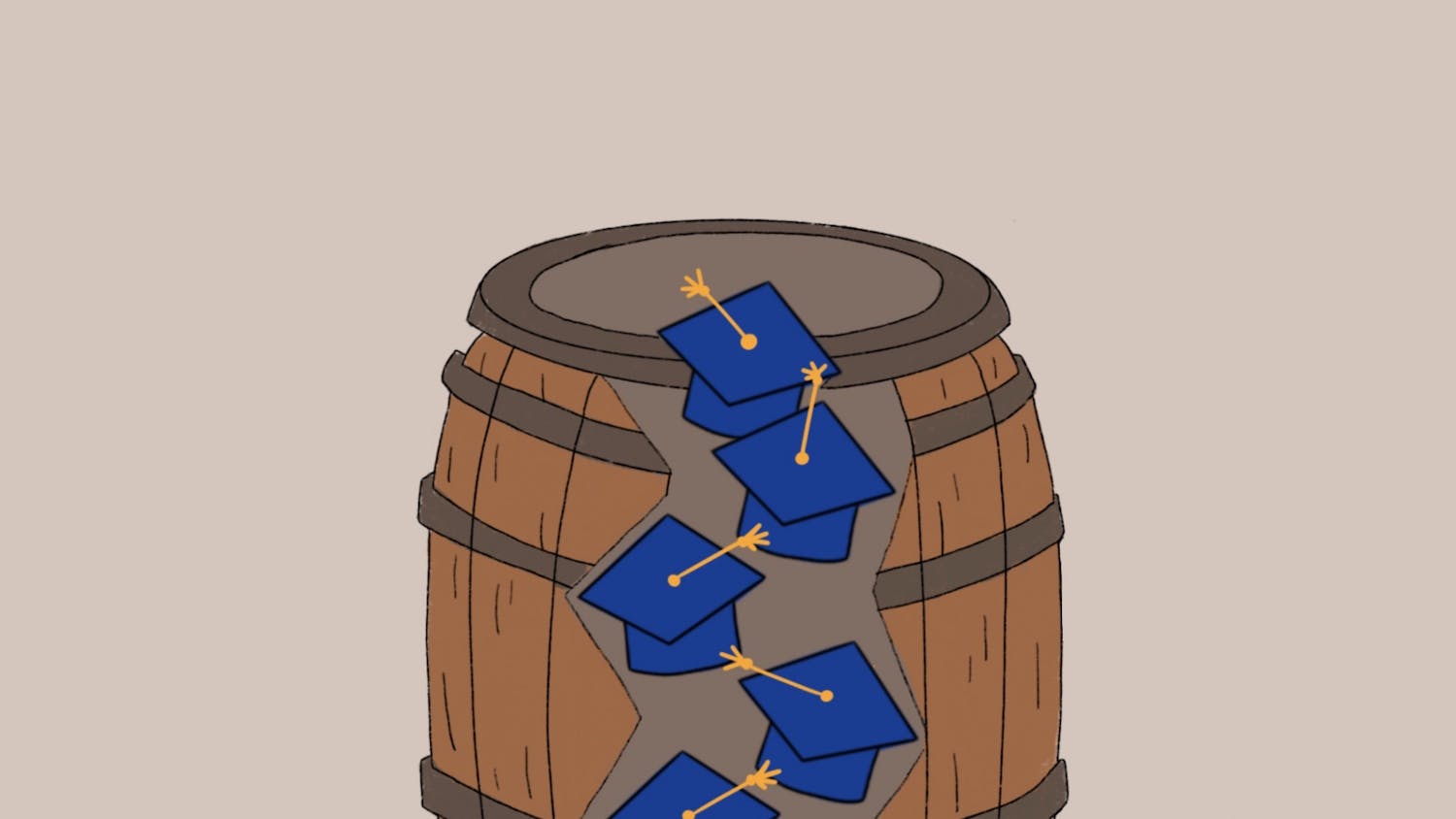

"It's a big responsibility and you can get yourself into a lot of trouble misusing credit," Tonini said. "We deal with thousands of people every year who are in that situation where they didn't handle it responsibly and through circumstances they got into trouble with overspending and costs."

Tonini said companies give free reign when it comes to spending.

"The danger of using a credit card, of course, is that it is so tempting to whip out that card at every purchasing opportunity," Thommesen said. "Then to not pay the full bill at month's end is when the debt piles up. If you cannot discipline yourself, then perhaps you should not have one."

Thommeson suggests students get a fixed rate.

"If you plan to pay off the bill every month, then get a card with a low yearly fee," Thommeson said.

Do you like this story? The Plainsman doesn't accept money from tuition or student fees, and we don't charge a subscription fee. But you can donate to support The Plainsman.