Most of Auburn anticipates the result of a coming Sept. 24 highly controversial vote regarding an increase in Auburn's property tax. The tax will be wide reaching and could lead to increases in students' rent payments.

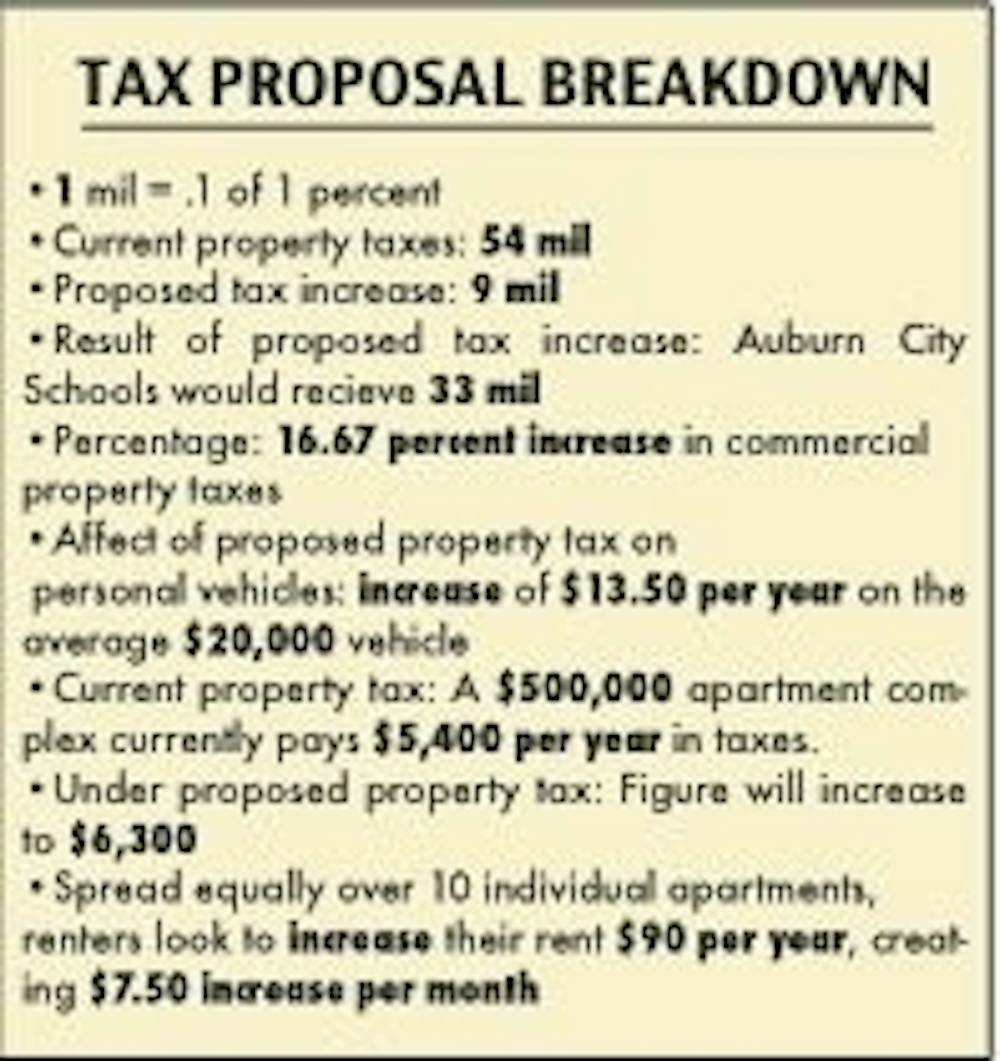

Auburn City Schools currently function under less than 24 mil, of which 19 mil goes directly to the Auburn school system, a percentage to the county and then 3 mil to the Alabama Board of Education. The city aims to increase property tax by 9 mil to 33 mil creating a property tax, real and personal property including motor vehicles, increase from 54 mil to 63 mil.

A mil is 1/10th of 1 per- cent; in this case that percent is calculated from the total amount of property tax.

"From what I've seen across the state, that is an ambitious number," said Lee County Revenue Commissioner Oline W. Price.

Auburn City Manager Charles Duggan said they went with the bare minimum they thought would do the job so they weren't asking for the citizens to pay more than they needed. Figures are based off how much revenue 9 mil collected last year.

The city is borrowing this money by floating a bond, which essentially means the city is going into debt to build the school and the proceeds received from the 9 mil tax increase will go toward paying that debt service back.

The average cost of construction of a high school is $65 million, which is the anticipated cost of this high school. The new school will serve grades 10-12 and measure 375,052 square feet at 158 square feet per student to potentially house 2,400 students.

Duggan said the reason the school board doesn't already have the necessary funds to contribute to construction relates to the four elementary schools constructed in the past 10 years and continued renovations to current schools.

"They've done their best to endure the growth, and now they can't handle it anymore." Duggan said of Auburn City Schools. "We've gone from 11th in the state, per-people, spending at 45th. You can't continue to have a quality school system like this, year after year, spending 45th in this state in education. This is one of the least-funded public school systems in the country, as far as statewide. You can't say there is a one-to-one correlation with the more money you spend the better education you have, but I don't think anyone says that when you continue to erode your spending on the kids that it doesn't have an effect on their education. It has to.

If the tax is not passed, Duggan said the school system will have to start finding money, which will come in the shape of portables and course and bussing cuts.

"They do have to find money from somewhere," Duggan said. "The do have to provide the core English, science, math, history classes. If the vote passes, they will know they have the current funding in place to fund all those programs they currently have, and then they'll have the new funding to fund the classroom space that's needed. If the classroom space isn't funded, and they're going to have to have it anyway, they are going to have to go to the programs and see what can be cut."

If passed, the tax increase will go into effect October 2014.

Figures provided by the city of Auburn show an average homestead property owner-occupied with the standard $53 exemption, home value at slightly under $250,000. For a home of that value, this 9-mil increase increases property tax $225, making the annual tax payment $1,522, up from $1,297 in 2012.

Price said property taxes will increase 16.67 percent per full value of a commercial property. There will also be an increase on property taxes of personal vehicles by approximately $13.50 per year per $20,000 of the vehicle's fair market value.\0x2028 However, commercial property will be double that of homestead property.\0x2028 Auburn University students could also be affected, as the increase in taxes will affect apartments and housing complexes.

Price gave the example of a hypothetical complex at a $500,000 value, which now pays $5,400 per year in taxes. That figure will increase to $6,300, a $900 increase. Spread equally over an estimated 10 apartments would thus result in a $90 per year increase per apartment, making an individuals rent raise $7.50 per month.

This also applies to personal property within the apartments, such as appliances or furnishings owned by the complex. If worth $500 would create an average increase, if at an assessed value of $100, of $96.30 per year.

This leaves students' rent to increase an average of $8.03 per month.

"There's no way of knowing exactly what will change." Duggan said. "Rent won't go up appreciatively, when you think about it, because with the vacancy situation that we have with apartments in town. No one is going to pass all of the tax on to the people they are renting to and not have people move to other places. It's basic economics theory that some of it will be born by the renter. Probably what will happen, it will eat into the profits that a normal rent increase each year will be for the people who own the buildings.

Price disagreed.\0x2028 "I've talked to a lot of commercial property owners and I would imagine they're going to adjust their rents accordingly," Price said.

Tim McGowin is an Auburn University graduate, local resident and rental-property owner. McGowin also said if the property tax increase were approved, he would have no choice but to increase rent for his own tenants. Though undecided on how much more to charge, McGowin said it would be at least enough to cover the tax increase.

The school isn't expected to open until fall 2017, at the earliest, and none of the students currently in high school would attend this school.

The city anticipates it will take 30 years to repay the debt in full.

This will happen at a 5 percent interest rate, which will net $8.5 million per year. The 9 mil increase will generate more than $7 million in its first year and is anticipated to increase each year.

"It makes a lot of sense if you're going to have an asset that is going to last a long time," Duggan said. "What you do is you spread out those payments over many years and part of the advantage is that future generations that will be helping to pay for it are also the ones that are using it."

The last tax increase was in 2007 for school upgrades at a rate of 7 mil.

"I think it's critical," Duggan said. "The city of Auburn I really think of as an education town. The University is world-renowned. We have a public school system that is excellent; children that want to go to elite schools are getting the education they need to be able to qualify for those schools. It really does provide top-to-bottom, across the spectrum for all the levels of kids to get whatever level of education they want to get. If that starts decreasing, I think the town will change."

Do you like this story? The Plainsman doesn't accept money from tuition or student fees, and we don't charge a subscription fee. But you can donate to support The Plainsman.